- 100% Online Processing

- Fast Transfer

- Approved in 1 business day

- USD, CAD, EUR, GBP , AUD, NZD , SGD, TRY, AED IBAN's

- Low Cost for Sending and Receiving

- Global ATM Network

- Free Standard Transfers

- One partner. Multiple solutions

- Support in English, Spanish, Portuguese, German and more

Local Personal IBAN's backed by High Street Banks.

Send Money

Transfer money between banks, or from your account

USE THE STANDARD DEBIT CARD

Get a new card, spend abroad, and get cash out from ATMs.

RECEIVE AND ADD MONEY

Get paid into or add money to your account.

Direct Banking

Get your IBAN's in USD EUR CAD GBP AUD NZD AED TRY SGD currencies.

Payment Types

SWIFT Multi-currency, SEPA Euro, GBP Faster Payments, GBP CHAPS, FX Payments and many mire

Transfer

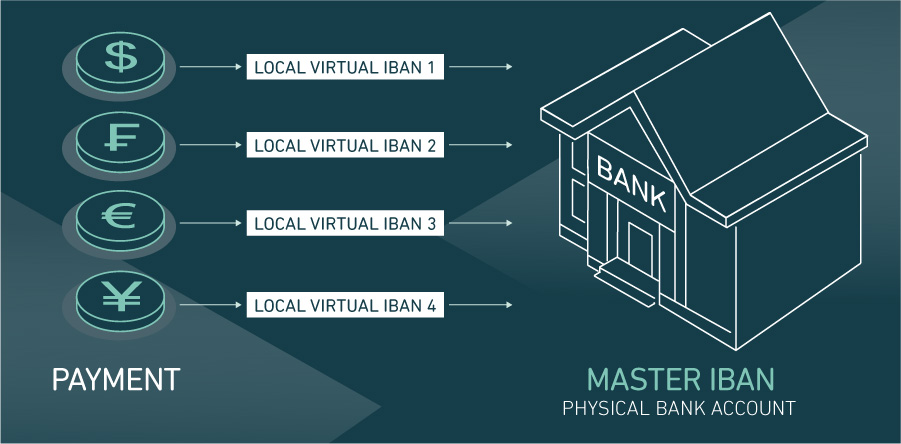

International transfers turned into local transfers

High speeds. Low fees. No hassle.

Collect Money on your Personal / Business name.

Digital Banking for Personal and Corporate Clients.

InterBank , SWIFT, SEPA, Cards and Crypto Payments.

The faster way to transfer money

Send money to over 160 countries—or to your nextdoor neighbour—from wherever you are, in minutes. You can even do it on the weekend.

Send money for much, much less

Get used to low fees and great exchange rates on international money transfers

Sending money to another Standard Account

It’s free to send the same currency from one Standard Account to another. When you send to a different currency, there’s a small conversion fee.

Get USD,CAD and many more currencies IBAN’s/ bank accounts online.

A full insured banking network for you.

Minimum initial deposit, Visa/Master/Standard cards, ATM access, and low charges for Sending & receiving.

OUR 2 PRINCIPLES

Low, and getting lower

We charge as little as possible, and we’re on a mission to drop prices until we’re eventually free.

Share finances with partner

We’re honest and upfront about what things cost, we use the mid-market rate, and never hide fees.

Frequently asked questions

1Are there limits to how much I can send?

Yes, there are limits for how much you can send with us. They depend on which currencies you send to and from, and how you pay. You can check the limits for each currency in the Currencies articles. We’ll also let you know if you try to send too much at one time.

2Fees for sending money

To see exactly how much your transfer could cost, visit Transfer section . Or read on for a bit more detail on how we work the price of your transfer out.

How we work out the cost of a transfer How much a transfer costs depends on three things — the amount you’re sending, how you pay, and the exchange rate.

The amount you’re sending The more money you send, the more your transfer costs. That’s because the Standard's fee is worked out as a percentage of the amount you’re sending. The percentage varies from currency to currency, and you can check it on our pricing page. The exception to this is if you’re sending a small amount of money, in which case there’s a cheap, minimum fee.

How you pay There are different ways to pay depending on the country you’re sending from. You’ll see how much each payment method or type of transfer costs when you set up your transfer.

The exchange rate You always get the mid-market rate — it’s the one banks use to trade between themselves. Because we never mark this rate up, your recipient typically gets more money at the other end.

The mid-market exchange rate is always moving. So for some of our currencies, you can lock in the rate you see when you set your transfer up — and you’re guaranteed to get it, as long as we receive the total amount in the stated timeframe (normally 24 or 48 hours).

3Is it safe to send large amounts with Standard?

It can be stressful sending large amounts abroad. So we do a lot to make sure you, your money, and your data are always safe and protected.

We’re regulated as Money Service Business in US and Canada.

. We operate according to the rules they’ve made to protect consumers in each region.

We safeguard your money

When you use Standard, we safeguard your money by holding it in dedicated bank accounts or high quality liquid assets.

The money in your account is covered by assets that are worth the same value. We hold the assets in separate accounts with these financial institutions.

We make your login safe

You can protect your account with 2-step verification. Every time you log in, and every time you make a transfer, we’ll ask you to verify that it’s you by text message, fingerprint, or face recognition. This way no one else can access your account or make payments on your behalf.

We have dedicated anti-fraud and support teams

Our fraud team makes sure our customers, and their money and data, are protected from fraud.

We also have a support team dedicated to helping people who send large amounts with us. If you have any questions or concerns along the way, just get in touch.